The Collapse of Silicon Valley Bank

The Pragmatic Engineer

MARCH 13, 2023

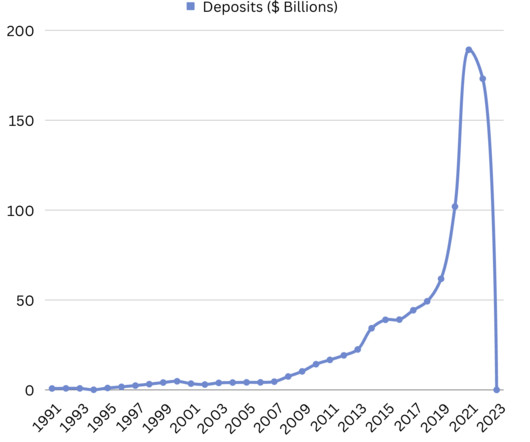

In case you somehow missed it: we went through the fastest bank run in history, in an event that impacted about half of all VC-funded startups in the US and UK. ” There was no certainty for startups with money in Silicon Valley Bank. Deposits in Silicon Valley Bank, 1991-2023. The bank was founded in 1983.

Let's personalize your content