Pricing plays a crucial role in the success of any (consumer packaged goods) CPG organization. Beyond covering the basic costs of development, manufacturing, marketing and delivery, the price assigned to a product signals the value it is expected to deliver in both absolute terms as well as relative to other offerings. Careful consideration of these factors allows some brands to command a premium for their products while others find themselves constrained by the competition.

While a base price sets the bar for a brand's offerings, short term discounts and promotions can be used to move the needle on consumer demand. Applied intelligently, these temporary price reductions can be used to attract new customers, move inventory backstock and thwart the introduction of competitor products. But applied haphazardly, these tools can affect consumers' willingness to pay, effectively locking organizations into a lower than desired price point.

And as organizations wrestle with demand-side considerations, costs are ever creeping higher. Recognizing that a price change has the potential to reposition a product relative to the competition, manufacturers are always examining ways to squeeze cost reductions from the backend. In periods of volatility and inflationary pressures, these organizations must struggle with whether to simply take the hit to their margins in order to preserve their position in the market or find creative ways to pass along the costs.

Pricing Analytics Is an On-Going Effort

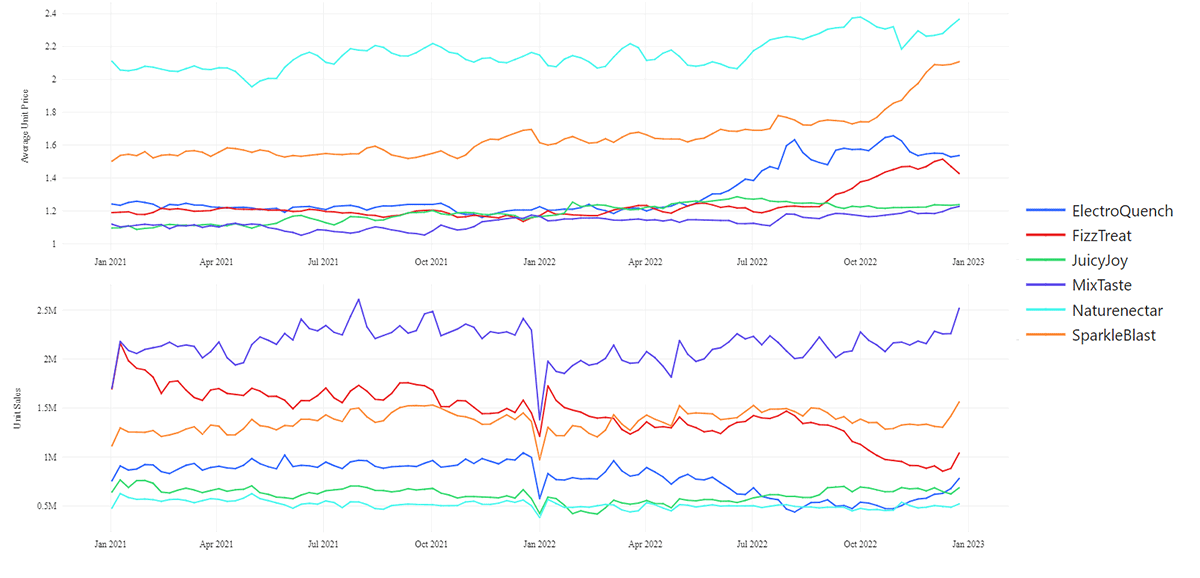

The importance of pricing to the near-term and long-term health of the business means that the examination and re-examination of pricing decisions is a constant feature of CPG organizations. Dedicated teams of analysts often pour over reams of internal and external data to identify trends in the marketplace that indicate how pricing decisions affect volume sales. (Figure 1)

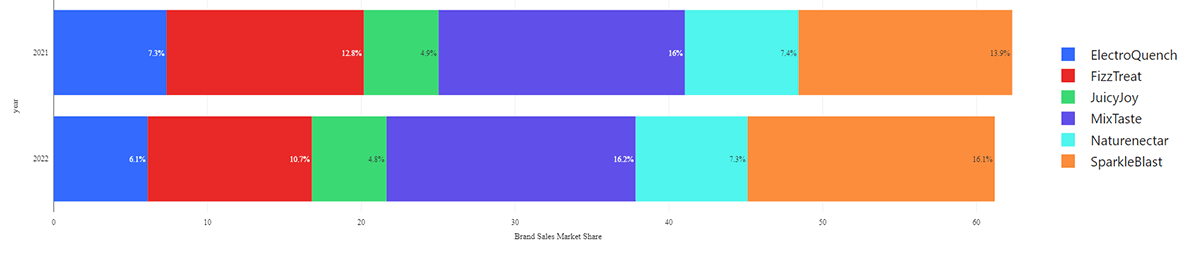

The impact of these decisions not just on revenues but also market share are key considerations in deciding when and how to approach pricing and promotional considerations. (Figure 2)

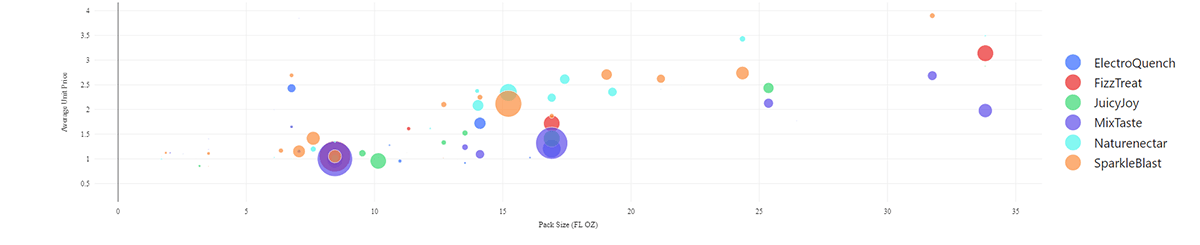

An examination of price and volume for various pack sizes provides insight into how organizations may shuffle package variations to consolidate market share, command premiums and otherwise avoid unproductive competition. (Figure 3)

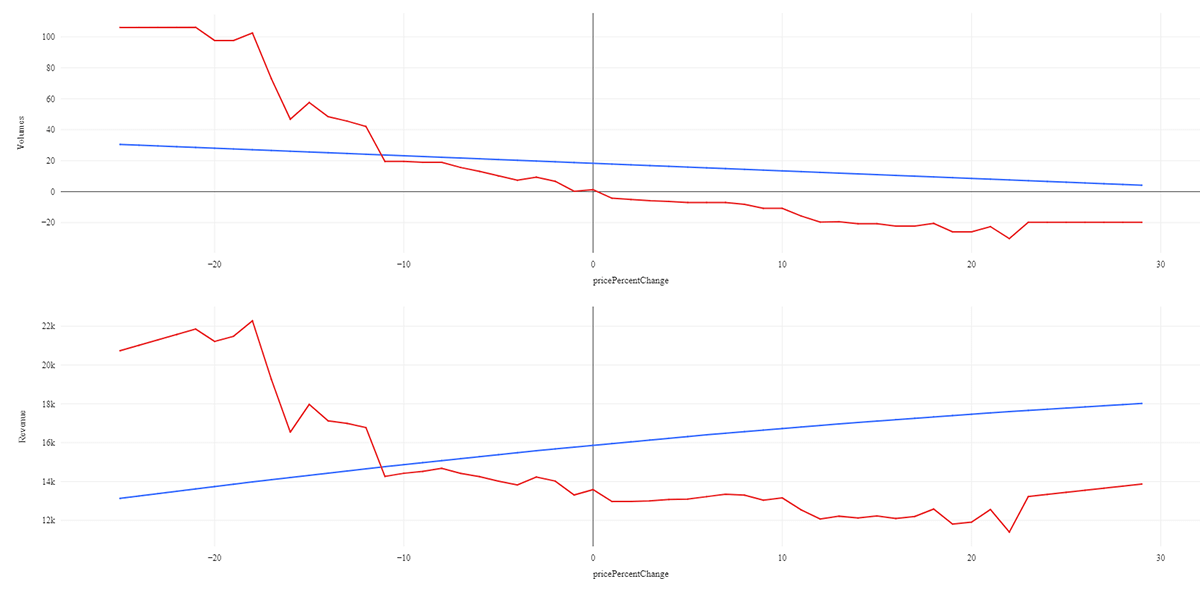

And the modeling of the relationship between price and volume changes across a variety of marketing conditions provides the basis for the examination of the impact of a variety of potential pricing changes.

The Databricks Lakehouse Platform Is a Key Enabler

These specific analyses are by no means comprehensive, but they reflect the range of techniques organizations may expect to perform. From exploratory data analysis to advanced statistics and machine learning modeling and even simulation, pricing analysts need the ability to easily pivot between techniques as questions arise.

Dependent upon access to a deep and rich repository of both internal and external data, organizations need to be able to provide these teams with performant, scalable and secure access to up-to-date information so that their work is always timely and accurate.

And given how these data provide insights into the core of the business and how it is performing within the larger market, it is absolutely essential these data be protected and effectively governed to ensure their appropriate use in driving the organization's objectives.

This is a tall order for any data and analytics platform, but the Databricks Lakehouse has been purposely built to facilitate the full range of data processing and analytics required in this scenario. As a unified data and analytics platform, pricing analysts can feel comfortable that the full range of their analytics needs can be addressed directly through the platform or through a wide range of connected analytics tools without the need for data to be replicated across multiple systems.

To enable the data engineering that provides the basis for this work, the Databricks Lakehouse is equipped with a full set of scalable, cost-performant capabilities supporting both scripted and database-like interactions with both structured and unstructured data in both real-time and batch modes. For access to external data, a wide variety of organizations are leveraging Databricks' Delta Sharing capabilities to provide fast, reliable and secure cross-organizational data exchanges, and numerous third-parties (including Crisp for sales and inventory data) are making their data available through the Databricks Marketplace.

And all of this work is protected through Databricks' centralized governance layer, Unity Catalog, which provides permission based control over data, models and other assets developed by data engineers, analysts and data scientists as well as full audit and lineage capabilities providing an additional layer of oversight to the information managed through the lakehouse environment.

Redkite's Deep Domain & Analytics Expertise Ensures Success

But technical capabilities are only part of the solution. Deep domain knowledge and analytic expertise are required to convert raw data into the insights required by the organization. With decades of experience implementing pricing analytics solutions and guiding CPG organizations through the interpretation of the results, Redkite is the perfect organization to help you get your Databricks-enabled pricing analytics environment off the ground.

As a demonstration of the kind of work Redkite frequently performs, they've collaborated with the folks at Databricks to demonstrate many of the common techniques employed by pricing analysts as part of a new pricing analytics solution accelerator. These notebook assets are free to download and run in your environment to help your organization explore how these challenges might be solved through the use of Databricks's lakehouse platform.

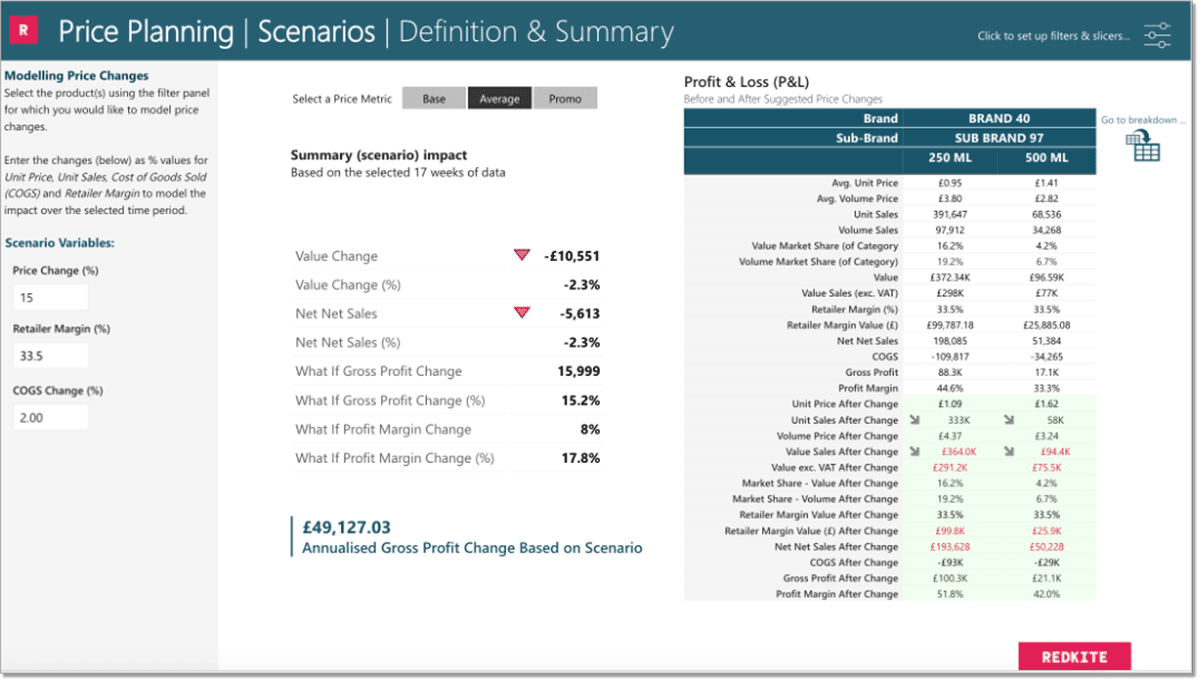

The techniques demonstrated in the solution accelerator represent a subset of the capabilities Redkite has packaged in a ready-made but fully customizable pricing analytics solution. (Figure 5) Built-on Databricks, this solution takes advantage of the breadth of technical capabilities found in the Databricks platform and encapsulates a full set of pricing analytics capabilities based on Redkite's expertise in this space. Through this solution, Redkite delivers a user-friendly solution that empowers pricing teams to query their data for crucial pricing insights and navigate the outcomes to make informed decisions in support of their short-term and long-term pricing goals.

If you'd like to explore this solution in more detail, please contact the Redkite team to request a demonstration.