How BI Can Inform Your ERP Selection Process (Manufacturing)

For businesses that derive their revenue from Manufacturing or Distribution, the choice for ERP includes MS Dynamics 365 Biz Central, SAP Biz One Pro, SYSPRO, Netsuite, Acumatica.

The purpose of this blog is to provide an example of how a manufacturing operation can use Business Intelligence (BI) anchored in its economic engine, to inform the ERP selection process.

The cost of an ERP is high and the deployment cost even higher, especially when the project takes circuitous routes.

Consequently, ERP selection is an exercise that has major consequence and it is important to put first things first when embarking on the selection process.

What are first things?

The answer to this lies in the reason for ERP selection.

You're in the market for an ERP for two reasons:

To Automate your unique System of Business

To have a data-driven Business Counsellor - a machine that brings to you in real-time, specific courses of action to grow your business

To find the complete answer to both of these questions it is necessary to begin with the end in mind, namely, 'what intelligence do I require about my business in order for me to take action to see growth in my business?'.

Once I have this information then I can design a full suite of workflows and then select the ERP technology that best fits my Automation and Counselling needs.

How Business Intelligence Informs Your ERP Selection

So, back to our purpose for this blog - how to use BI to inform my ERP selection process.

Let's use the example of a manufacturing company that is in the thick of selecting an ERP for the stated reasons above. Such a company has many systems within it that have targeted objectives and it is important to do this exercise with every system that serves the growth of your business.

I'll use the concept of the Cash Conversion Cycle (CCC) - which has many supporting systems - to inform us on one aspect of our choice of ERP.

The CCC is an apt fit for Manufacturing operations because manufacturing is often inventory heavy and the CCC is a rigorous way to include pre and post manufacturing inventory into the production of cash.

The object of the CCC is to measure how efficiently a company manages its working capital.

It tracks the time it takes for a company to convert its investments in inventory and other resources into cash from sales. It's calculated by adding the days inventory outstanding (DIO) to the days sales outstanding (DSO), and then subtracting the days payable outstanding (DPO). Essentially, it shows how long it takes for a company to receive cash after spending money on inventory and other working capital expenses.

A shorter CCC indicates better efficiency in managing cash flow.

How is this done ?

We use the dashboard above as a guide and work back to the data required to be furnished by the ERP. Looking at the dashboard below it is clear that at least the following data points are required:

Cash

Types of Bank Accounts

Bank Transactions

Bank Balance

Lines of Credit and other Loan Accounts

Accounts Payable

Vendor Profile

Purchase Orders

Inventory Arrival Date

Purchase Transactions

Vendor Payment Terms

Due Dates for each purchase transaction

Value of Purchase Transactions

Accounts Payable Analytics

Inventory (Pre-Manufacturing)

Builds of Material for all Manufactured Products

Manufacturing Schedule by product

Lead Time by Inventory Item

Current and projected material costs

Materials on order

Warehouse space available for inventory

Materials On Hand

Materials committed to Production

Inventory (Post-Manufacturing)

Sales Demand by product

Manufacturing Lead Time by product

Production Schedule

Warehouse space available for new inventory

Inventory On Hand

Inventory committed to Customers

Projected Demand on Production

Sales

Sales Pipeline by product

Sales Orders - Due Dates

Sales Order - Total Value

Accounts Receivable

Customer Profile

Sales Orders

Required Delivery by product

Sales Transactions

Customer Payment Terms

Value of Sales Transactions

Accounts Receivable Analytics

Validating Your Conclusion

The list of data points above should be rigorously validated and the most comprehensive way to validate this list is to workflow each part of the business. A workflow of each step of the process will reveal the dat point required to actualize the process.

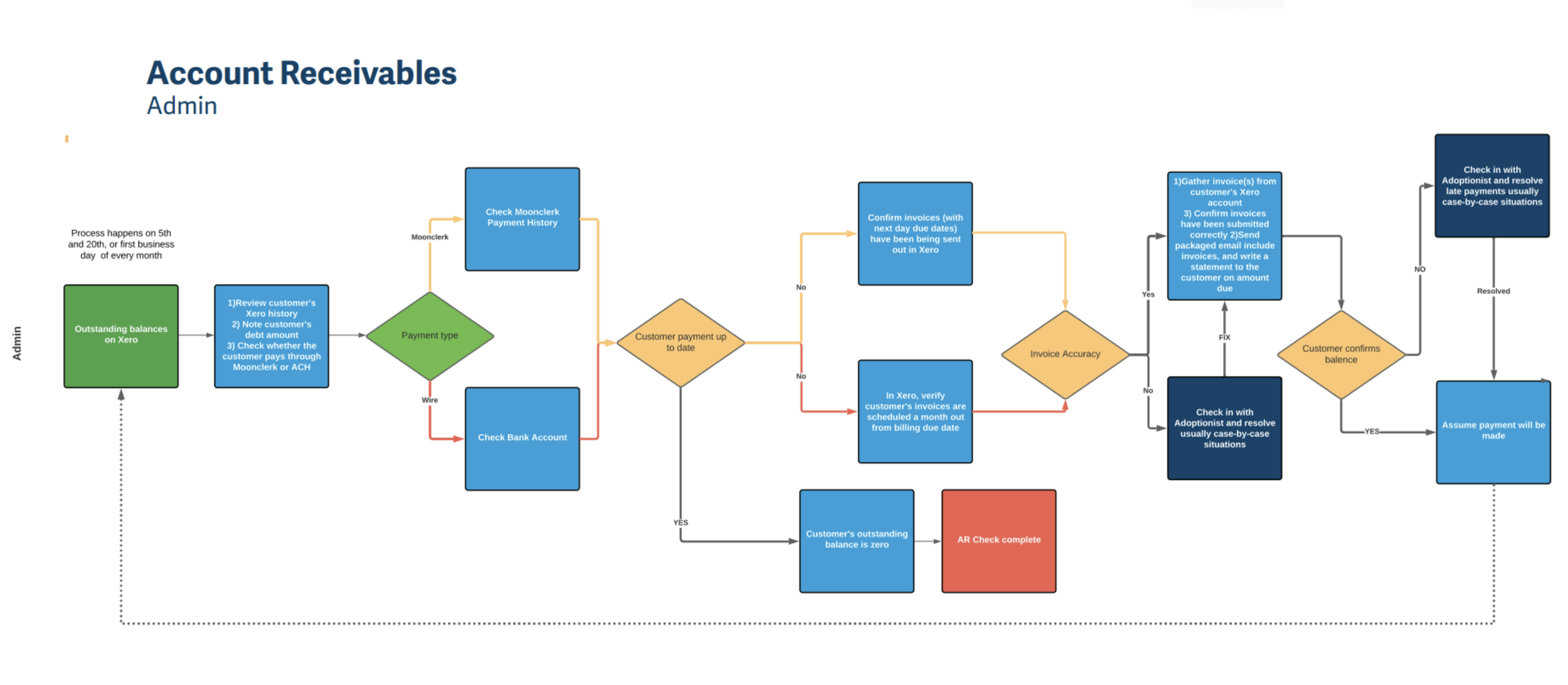

Below is an example of how a company can workflow its Accounts Receivable. The workflow captures every step that is required for the particular aspect of the business - in this case Accounts Receivable - to be complete and accurate.

So my requirements for BI above, combined with my tight process documented in this workflow example, provides me the gap analysis that is required to make the right ERP selection for my business and save millions in costs that can result from making the wrong ERP selection or taking the wrong path with the right ERP.

Conclusion

ERPs are a big investment, ERP Deployments even bigger and the cost of getting it wrong dwarfs both of these. Business Intelligence combined with Business Workflows for every growth-driving aspect of your business will inform all your ERP buying decisions. In the example above we demonstrated how the Cash Conversion Cycle can do exactly this for a specific growth-driving aspect of a Manufacturing Operation.

If you take two things away from the above, let it be:

1) the permission to intentionally leverage BI to inform your ERP acquisition decisions AND

2) the importance of the Cash Conversion Cycle in measuring the efficiency of your working capital management.